Developing countries are often the hardest hit by floods, cyclones, droughts, and earthquakes, yet are also the least equipped to understand or address these risks. There are a number of exciting innovations that could help – from crowd-sourced mapping projects that that reveal hazards with unprecedented precision, to self-learning modeling algorithms that can predict a disaster before it strikes. The real challenge, however, is bringing together those who understand these new technologies with at-risk communities on the ground.

This is why the Challenge Fund was created. An initiative of the Global Facility for Disaster Reduction and Recovery (GFDRR) and the UK’s Department for International Development (DFID), the Challenge Fund aims to connect innovation to local contexts to help better identify changing climate and disaster risk and enable more effective decision-making to build resilience. Through targeted investments in innovation, the Challenge Fund is better enabling communities to build resilience to climate change and natural disasters in more than 20 countries around the globe by moving from data to insight to behavior change.

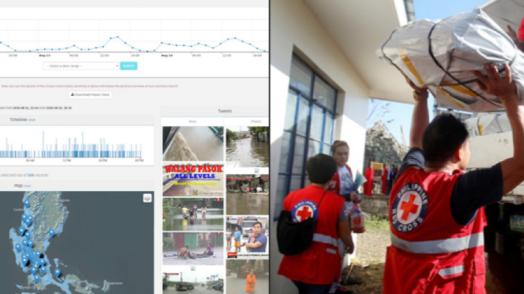

Through more than $1 million in financing for innovation, the Challenge Fund has already helped fund more than 15 projects, tackling issues like gender, language barriers, open data access, and gaps in risk communication. From collecting data through Twitter for flood analysis in the Philippines, to visualizing risk data for civil society groups in Africa, Challenge Fund winners are harnessing the power of technology for climate and disaster resilience. View the full program overview here.

Round 1 of the Challenge Fund consisted of two phases. In Phase I, more than $1 million in targeted investments in innovation were distributed to 15 projects, tackling issues like gender, language barriers, open data access, and gaps in risk communication.

In Phase II, select projects were given additional support to deepen their engagements in resilience. These projects include:

- Multilingual films for resilience to risks from volcanic hazards (Final report)

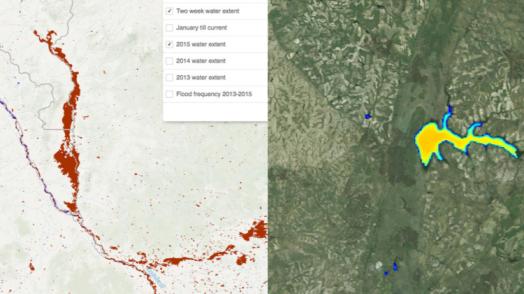

- Web map services to improve real-time flood data in Africa; (Final report)

- Participatory terrain data and modeling; (Final report)

- Real-time urban flood risk data via cellphone network analysis; (Final report)

- Open source mobile weather stations for flood resilience; (Final report)

- Developing an open source, real time, probabilistic drought risk visualization; (Final report)

- Enabling institutions to manage storm surge risks. (Final report)

Through additional funding from the Belgian Development Agency, two Phase I projects - Using Twitter data to map flood risk and Multi-hazard school safety in Indonesia through science-based information – are being scaled in Tanzania (Final report) and Mozambique (Final report) respectively.

In an effort to further explore the disaster risk management community’s perspective on priorities for producing better disaster risk information for developing countries, GFDRR and DFID launched the Solving the Puzzle: Innovating to Reduce Risk.

The report revealed that in many developing countries, there simply isn’t enough available data related to risk - limiting the development of risk-reducing policies. In August 2016, the Second Round of the Challenge Fund was launched, focusing on key challenges identified in the Solving the Puzzle report, namely to develop a framework that facilitates a multi-hazard view of risk.

With Tanzania as the pilot country, the winning teams are tasked with developing:

- Data schema and data for multi-hazard database – British Geological Survey (Final Report)

- Data schema and data for global exposure database – Global Earthquake Model Foundation (Final Report)

- Data schema and data for a global database of vulnerability functions – University College London Consultants (Final Report)

Developing countries are often the hardest hit by natural disasters such as floods, cyclones, droughts or earthquakes. Yet, they are the most sensitive to the budget volatility caused by major catastrophes, and are the least equipped to prepare for these extreme events. Financing is at the core of any disaster management action, whether risk reduction, preparedness, financial protection, or resilient recovery. Unfortunately, financing after a disaster is often long delayed, increasing the human impact.

The application of new technologies to risk financing could revolutionize financial mechanisms, for example by better targeting funds to vulnerable communities both geographically and temporally. These innovations include forecast based mechanisms that can fund early-action before a disaster strikes, or big data (very large datasets that can be automatically processed and analyzed) and machine-learning algorithms that can improve exposure and/or damage assessments and accelerate payouts. The real challenge is bringing together the technical experts working on these approaches, with the operational experts implementing risk management programs, and at-risk communities in affected countries.

In May 2018, the Global Facility for Disaster Reduction and Recovery (GFDRR), the World Bank, the UK Department for International Development (DFID), and the Centre for Global Disaster Protection launched a new Challenge Fund to pilot and support the development of innovative risk financing mechanisms and align global innovation with on-the-ground user needs. This round called for projects that help bring these communities together and strengthen financial resilience in developing countries. It received support through the InsuResilience Climate Risk Financing and Insurance Program MDTF, in association with the InsuResilience Global Partnership. It builds on the success of previous rounds focused on risk identification.

Round 3 Winning Projects

Towards Impact-Based Forecasting: Upgrading InaSAFE and GeoSAFE to Enable Forecast-Based Action

Implementing FbF is often quite difficult, because when a hydrometeorological forecast arrives, it is not clear to humanitarians what kind of impacts to expect (Houses destroyed? Roads closed? Where?). Without information about potential impact, humanitarians do not know what early actions to take and where to implement them. To answer these questions, the Red Cross Red Crescent Climate Centre and partners have adopted the concept of Impact-based Forecasting (IbF) an approach that combines the understanding of forecast skill, impact-hazard curves, and risk analysis to generate an intervention map that will inform when and where funds for early action should be deployed.

SMART: A Statistical Machine Learning Framework for Parametric Risk Transfer

Despite the advantages of simplicity, transparency, and rapid payouts, there is a lack of confidence and reluctance to use parametric insurance because of basis risk – the misclassification of events due to false positives and false negatives. Basis risk leads to inefficient transactions and higher product costs, reducing their appeal to end-users and investors. This project will make novel and expert use of appropriate machine learning and statistical concepts to address these two issues and develop a new framework that is of general relevance to diverse hazards and communities.

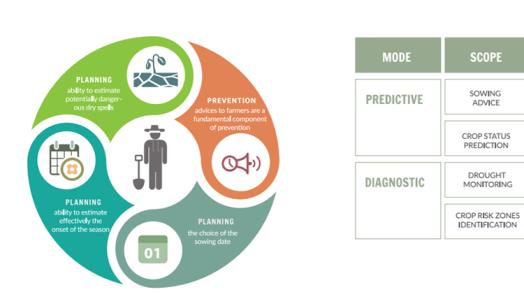

Forecast-Based Financing for Food Security

Despite advances in humanitarian aid and the growing understanding that pre-arranged disaster risk financing can be more cost-effective than post-disaster expenditures, associated uncertainties in forecast systems and cost-effectiveness remain large. As a result, forecast information is not routinely used as a basis for financing early action for food insecurity risk. Forecast-based Financing for Food Security (F4S) proposes to address this by: developing an impact-based forecasting model using machine learning on food insecurity drivers; collecting evidence on food insecurity triggers; evaluating the cost-effectiveness of different cash transfer mechanisms; and exploring potential channels to disseminate knowledge and make first steps towards operationalization.

The Challenge Fund - Round 3 centered on two thematic challenges and a special focus area.

Thematic Area 1: Disaster Risk Financing for Early-Action

Financing for early-action, for example using forecast based triggers, can help shift the humanitarian paradigm from response after a shock to early measures, at the first signs of an impending disaster. Such mechanisms could be integrated in large scale Disaster Risk Financing mechanisms for governments, e.g. through World Bank instruments (e.g. contingent credit, risk transfer solutions, emergency funds, etc.).

Thematic Area 2: Machine Learning and Big Data for Disaster Risk Financing

The application of big data (e.g. satellite imagery, social and news media, RFID/IoT sensors, mobile applications, community-based data collection) and machine learning algorithms have the potential to revolutionize disaster risk financing mechanisms before, during, and after an event.

Focus area: Disaster Risk Financing Mechanisms to Manage Food Insecurity

A special focus of this challenge fund will be on disaster risk financing mechanisms to support food security. While the selection team is looking for interesting proposals that help address food insecurity, this is not a requirement for success.

All grant proposals were required to meet the following criteria:

- all proposals need to demonstrate a new or different approach which requires funding from the challenge fund to get off the ground, and the proposal should demonstrate why this could not be supported from more traditional funding sources;

- all products and outputs should show a clear path to ultimately be operationalized on-the-ground, even if this proposal won’t take it all the way; and

- all approaches should be scalable to other regions or communities.

The Global Facility for Disaster Reduction and Recovery (GFDRR), the UK Department for International Development (DFID), Platform for Agriculture Risk Management (PARM), the Centre for Disaster Protection, and the World Bank’s Agriculture Observatory, Disaster Risk Financing and Insurance Program and its London Hub are launching a new Challenge Fund to support Southern African countries to develop innovative agriculture risk financing tools to help inform and support public sector policy and program decision making regarding allocation of public resources to reduce economic losses, poverty and food insecurity.

The increasing severity and frequency of extreme weather events and growing threats from plant and livestock pests/diseases threaten to undermine regional food security, poverty reduction efforts and the achievement of the SDGs.

The World Bank Group (WBG) has ongoing efforts for improving the managing agriculture risks and to promote climate change adaptation and resilience in the agriculture sector.

In order to prioritize investments in resilience and preparedness to reduce agriculture losses, poverty and food insecurity, and de-risk agriculture investments, decision makers need tools that capture accurately the economic and social impact of agricultural risks. To incentivize the development of these tools, the WB is launching an innovation challenge to the community of experts aiming at building integrated systems that can leverage existing data sources, analytics & models to assess in a granular, scalable and dynamic way the various dimensions of economic impact induced by agricultural stressors.

Scope of Work: The Challenge

Design a tool that can support public finance decisions based on an integrated approach for the management of agriculture sector risks. The tool will be based on an agricultural-focused financial model, to be used by national governments (Regional and subnational applications will also be considered) in Southern Africa (member countries of the Southern Africa Development Community - SADC) to understand and mitigate against the adverse financial impact to the public sector of extreme shocks to the agriculture sector (major hazards must include extreme weather events and second order effects on agriculture commodity price volatility and/or animal & plant diseases). The tool should allow for macro (national, sovereign) level risk financing decisions, but more disaggregated level analysis (subnational/meso and farm/micro level) is encouraged.

Who may apply?

The Challenge Fund is open to proposals around the thematic challenge (see below section 4) under a specific set of technical specifications.

Three key principles should inform all grant proposals:

- all proposals need to demonstrate a new or different approach which requires funding from the challenge fund to be developed, and the proposal should demonstrate why this could not be supported from more traditional funding sources;

- all products and outputs should show a clear path to ultimately be operationalized on-the-ground by Southern African Governments (individually at the national level or as a block at the regional level);

- all approaches should be scalable to other regions or countries in Sub Sharan Africa.

Individual projects may focus on weather hazards or multiple hazards using weather as the first order impact (see section 4 below). A clearly identified need or problem and a practical application of the proposed innovation will be key for a successful proposal.

Technical Specifications

The agricultural financial tool will need to explain the linkage between three main elements below in order to create a tool that will allow the development of probability estimates for financial losses. However, proposals that use alternative elements for risk analysis are also encouraged, in particular those using big data and machine learning to arrive at risk analysis for agriculture sector risk assessments.

- Hazards – the categorization and modeling of the weather risk being considered (rainfall, temperature, wind, etc.) plus any additional risk (food price, shocks, animal/plant health risks)

- Participants will identify the models and datasets necessary to model risks (see thematic areas below)

- Example of datasets used to model weather risks:

o Temperature measurements

o Precipitation measurements

o Soil moisture

o NDVI

o Evapotranspiration indices

- Vulnerability – an estimation of what the impact of the realized risk would be, given the assets affected by the event and considering the current ability to manage the. The vulnerability is heavily influenced by many local variables, such as soil, crop varieties, cultural practices, household income/poverty levels, and access/availability of irrigation, drainage, grain storage, weather info/advisory, and other infrastructure services. It should also be noted that the agricultural risk assessment is particularly dependent on the relationship between the timing of the loss event and the agricultural calendar.

For example, a measure of vulnerability is the percent lost in crop yields due to the occurrence of a particular weather event of a particular severity at a particular time during the crop growth cycle.

- Exposure – assessment of assets and communities “at risk”, from various perspectives, such as:

o Type of crops by location

o Livestock population and composition, by location

o Farm holdings/producers that may be directly impacted by hazard

o Agro-climatic zones

o Topography, vegetative cover, soil types, watersheds

o Crop yield levels

o Land use maps, irrigated zones

o Weather stations, other infrastructure

The risk assessment performed following the steps above will culminate with the delivery of outputs that would support the public sector’s decision making via the quantification of: (i) economic losses to the agriculture sector; (ii) changes in poverty rates; and (iii) changes in food security.

Core Thematic Area: Agricultural Financial Model for Weather Related Risks

- Fast onset risks: sudden, unforeseen events

o Excess rainfall and flood (riverine, flash, coastal)

o Temperatures (high/low)

o Wind (tornados, cyclones, etc.)

o Hail

o Bushfires

- Slow onset risks: cumulative events that occur over an extended period (drought)

o Rainfall deficit

o High temperatures (impact in evapotranspiration)

Optional Thematic Areas:

Additional Thematic Area 1: Agricultural Financial Model Animal & Plant Disease Related Risks

Additional Thematic Area 2: Agricultural Financial Model for Commodity (food) Price Risk (as a secondary impact)

What are the criteria for proposals?

Submitted proposals will be ranked according to the following criteria:

Required:

- Present a clear strategy for developing a tool for the public sector financing of agriculture risks (following the technical specifications described above) that assess the economic impact in agriculture, poverty and food insecurity, in the Core Thematic Area described above. Priority will be given to proposal that also add second order effects on risks from Thematic Areas 1 and/or 2 described above.

- Articulation of proposed tool (solution and approach)

- Identify existing data gaps in any of the model components (hazard, vulnerability, exposure) that pose difficulties to the development process and propose solutions to overcome them

- Geographical focus on Southern African countries (defined by those countries members of the Southern Africa Development Community – SADC)

- Establish a clear path towards operationalizing the product on-the-ground, by choosing countries where the tool would be implemented first (at least 2 countries within the geographical focus)

- Demonstrate the capacity of the proposed solution to scaleup to more countries/regions

- Meet World Bank eligibility requirements (see below)

Preferred:

- Development and usage of open access data, products, tools and approaches

- Open source technological solutions that are simple and replicable are encouraged

- Wherever data gaps have been identified, identify and propose alternative data sources and strategies to overcome the lack of the respective datasets.

- Projects that present a clear strategy for bridging the gap between innovation and users, including through co-productive approaches and user consultations

- Involvement of local research or other partners in developing countries on an equal basis.

- New partnerships to develop cross sectoral and collaborative teams (including members from the public, private, NGO and academic sectors)

- Encouraging training and capacity development of users

- Potential for using the tool beyond public sector (such as NGOs, banks, insurance companies, agribusinesses, etc.)

- Ability to leverage other projects and investment to deliver greater impact

What are the operating principles?

- More than one proposal per institution is allowed.

- The proposals must follow the provided template in the link below.

- Consortiums, partnerships and collaboration on projects among different organizations are encouraged.

The Challenge Fund aims to bridge the gap between innovators and users to build disaster and climate resilience. A demonstrated track record and interest in building resilience is key in any successful application.

What funding is available?

The winner(s) of the challenge will receive an invitation to a 2-day expert workshop in London during the month of August 2019 (travel expenses paid). The objective of the expert workshop will be to: (i) review the proposals in detail (through oral presentations and Q&A sessions); (ii) identify opportunities for partnerships among proponents; and (iii) identify opportunities for improving key data constraints. From the workshop, one or several proposals could be selected for receiving grants to develop the proposed tools in pilot country applications. Grants are expected to range from USD 100,000 up to USD 300,000. The proposal should clearly explain and justify the requested budget.

How do I apply?

Applications for this round are now closed. Here's what's happening next:

Proposals will be reviewed by a World Bank Expert Working Group. This will be based on the outlined criteria. Up to 10 proposals will be selected for invitation at the expert workshop. Successful applicants will be notified by email by July 1, 2019. Proponents should plan (if selected) to participate in the expert workshop in London on August 8-9, 2019. Note: If your proposal is selected, you may receive feedback from the Expert Working Group to maximize the impact of your proposal to be presented at the expert workshop. *For shortlisted applicants, a Request for a Powerpoint Presentation (RFPP) will be issued to get the material for further evaluation at the expert workshop on August 8-9 2019.

After the expert workshop, selected proposals will be asked to submit a full proposal by August 23, 2019.

The grant will be made upon completion of contractual negotiations with the World Bank Group. Awarded institutions must be able to meet the vendor eligibility requirements of the World Bank Group. Teams will have between 3 to 12 months to complete their project in the selected pilot locations (depending on the proposal, funding and number of countries to be covered).

Public Announcements of the Proposals Funded in this Round will be made in September 2019.

For more information, please email Diego Arias (darias@worldbank.org), Martin Gurria (mgurria@worldbank.org), and Chidozie Anyiro (canyiro@worldbank.org). Please see link below for questions received and responses given to date.