Growth and opportunity are concentrated in cities. So is risk. At the City Resilience Program, we embed resilience into urban planning, infrastructure, investment and government.

We support cities to better understand and address their disasters and climate risks. We work with them to identify viable urban resilience investments. And we bring in partners and financing from the public and private sectors to ensure lasting solutions.

As a result of our engagements, we help reduce vulnerability and accelerate the capacity for urban development.

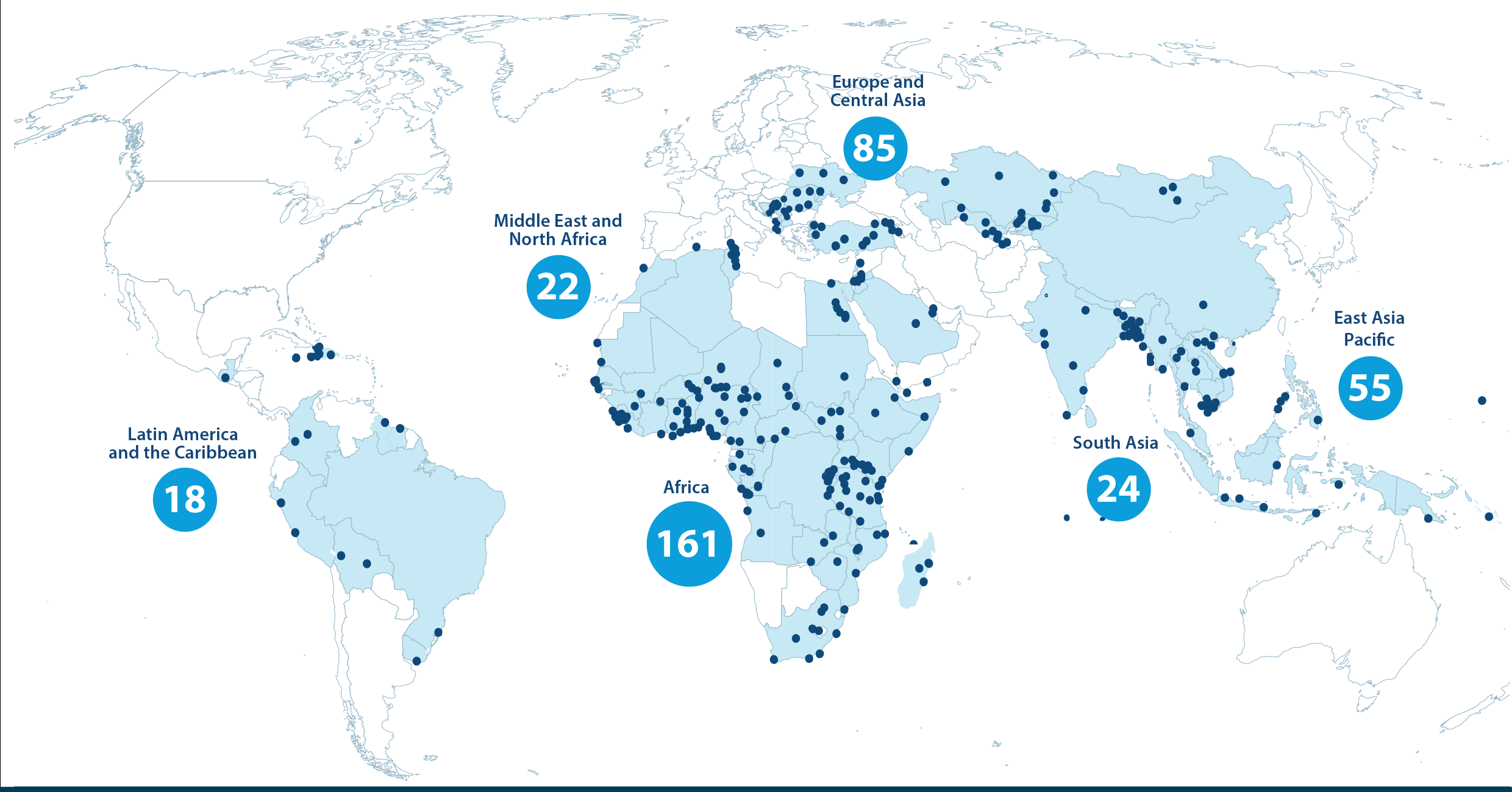

Since 2017, we have engaged in over 360 cities and influenced $8 billion in investments to strengthen urban resilience. Our work is enabled by our trusted practical experience, and our position within the World Bank’s global network of specialists and investments in development.

WHO WE ARE

The City Resilience Program is housed within the Global Facility for Disaster Reduction and Recovery (GFDRR) at the World Bank.

We are a global initiative supported by the Swiss State Secretariat for Economic Affairs, the Austrian Federal Ministry of Finance, the Italian Ministry of Foreign Affairs, the Italian Agency for Development Cooperation, and the Gates Foundation.

WHAT WE DO

We analyze the impacts of hazards and disaster risks, advance technical and financial capacity-building, and assist in mobilizing investments and leveraging partnerships for greater impact.

How We Work

We help cities build capacity and mobilize finance to deliver resilience investments. In collaboration with development partners, we bring resilience benefits to cities through projects financed by the World Bank and beyond.

We offer the following services:

Increasing urban resilience against growing climate and disaster risks requires a spatially informed approach that captures the interplay between the natural and built environments.

The City Resilience Program’s operational and technical support helps cities understand and plan for the increasing risks they face and prioritize policy and infrastructure interventions.

Our Resilience Planning team has developed a suite of standardized, rapid analytical tools, such as the City Scan and the country-level Urban Climate Risk Analysis.

Resilience planning offers bespoke analysis of a city’s resilience challenges and provides World Bank teams and municipal clients with tailored urban resilience advisory to inform investment decisions in light of those challenges.

This support can involve:

- identifying zones and sectors for priority resilience interventions

- estimating infrastructure costs and benefits

- helping with the technical aspects of an investment project

Further, this work provides cities with the means to quickly access best-in-class, highly specialized technical services in key topics, such as flood risk and extreme urban heat.

In the context of constrained government funding and capacity, private sector partners can help design, finance, deliver, operate, and maintain urban resilience infrastructure.

Our Finance Advisory Services provide upstream operational and technical support to mobilize both public and private financing of urban resilience investments.

It provides early-stage advice on how urban resilience investments can benefit from private sector participation. This includes concept-testing of investments and consultation with potential private sector investors in order to leverage private capital for urban resilience investments, through Public-Private- Partnerships (PPPs) or capturing increased land values.

We analyze the financial and regulatory contexts of specific project concepts by identifying and testing out business models.

This work includes:

- comparing scope options and contracting modalities

- costing, analyzing risk

- assessing the affordability of infrastructure

We also support the preparation of transaction documents: technical support related to government contracting and oversight of specialist transaction advisory services, ensuring procurements are completed successfully with contracts that will deliver urban resilience over the investment period.

The City Resilience Program alone cannot meet the strong demand from cities for support with designing attractive resilience investments and prioritizing resilience in their long-term planning. Through our network, we connect cities with partners who have interest and expertise in urban development and disaster risk management and can provide support with identifying solutions, designing investments, and funding them with public or private capital. These include international financial institutions, development partners, private sector investors, academic experts, and technology firms.

The City Resilience Program also fosters city-focused collaboration and knowledge development within the World Bank Group and beyond: building capacity of city officials through workshops and technical sessions and contributing to cutting edge knowledge development and sharing.

Highlights

Where We Work

Cities are the world’s centers of social and economic activity. Their concentration of people, assets and rapid urbanization comes with significant challenges, exacerbated by a changing climate. We have worked across 360 cities in 92 countries across all regions to help cities build capacity and ability to deliver resilience investments.

Our Impact

The latest events from City Resilience

Watch the City Resilience Program videos playlist on YouTube

The City Resilience Program’s work is made possible through contributions from: